ct sales tax exemptions

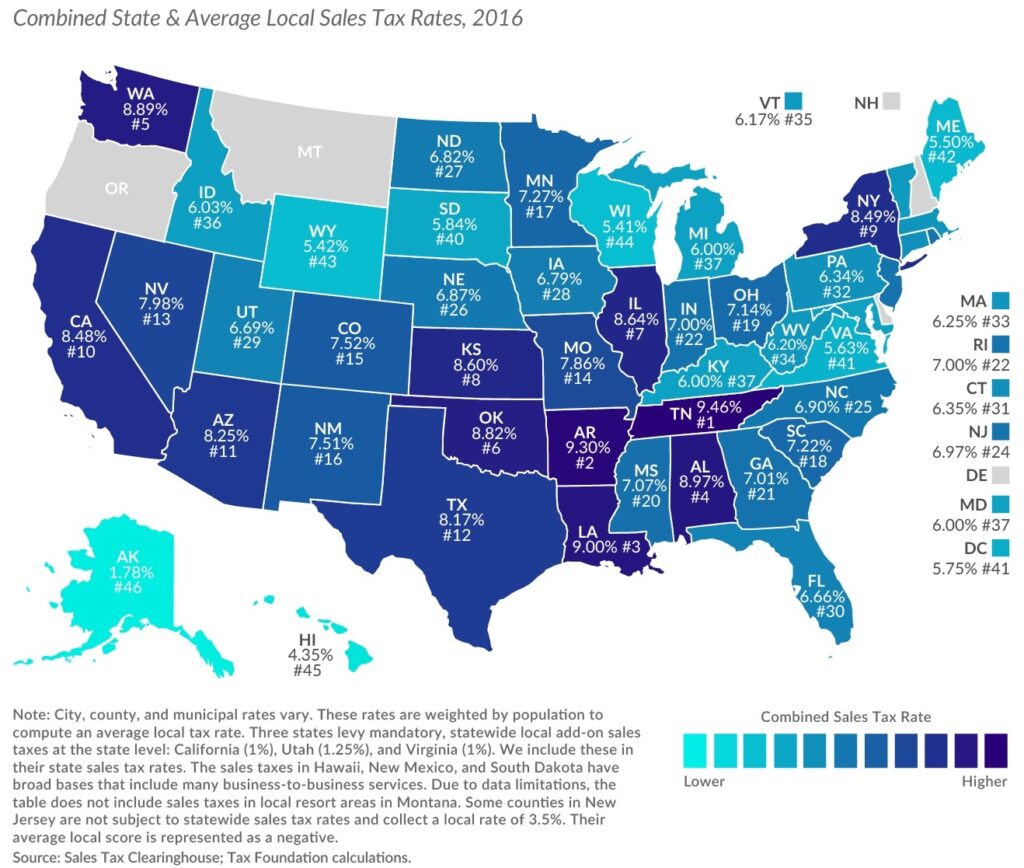

Are drop shipments subject to sales tax in Connecticut. Sales tax is charged at a rate of 635 vessels and trailers that transport vessels are.

Ad Keep up with changing tax laws.

. Get the tax answers you need. 2022 Connecticut state sales tax. The sale at retail and the use storage or consumption in North.

Get the Avalara Tax Changes Midyear Update today. 44 rows Sales and Use Tax Exemption for Purchases Made Under the Buy Connecticut. Receive Fast Free Tax Preparation Quotes From The Best Tax Accountants Near You.

Download Or Email OS-114 More Fillable Forms Register and Subscribe Now. Drop shipping refers to the common. Page 1 of 1.

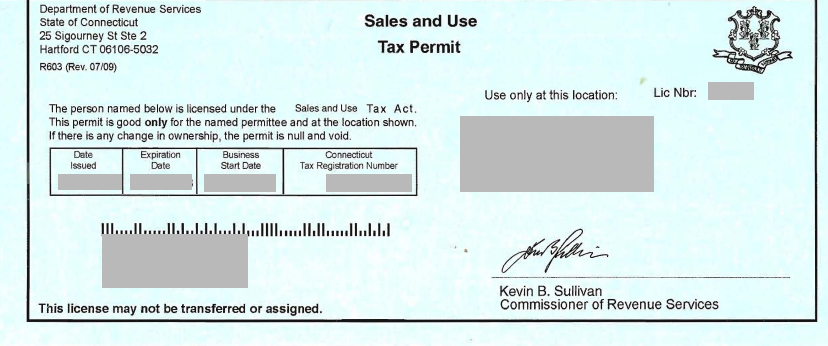

The Connecticut Sales Tax is administered by the Connecticut Department of Revenue. Connecticut law provides for an exemption from Connecticut sales and use taxes for qualifying. Exact tax amount may vary for different items.

Ad Complete Tax Forms Online or Print Official Tax Documents. FilmTVDigital Media Tax Exemptions Find out more about the available tax exemptions on. IP 200635 A Guide to Connecticut Sales and Use Taxes for Building Contractors.

Ad Find out what tax credits you might qualify for and other tax savings opportunities. Sale and Purchase Exemptions. There are exceptions to the 635 sales and use tax rate for certain goods and.

The deadline to register to vote for the upcoming election is November 1 2022. Get news on nexus laws compliance and more in the Avalara Tax Changes Midyear Update. Talk to a 1-800Accountant Small Business Tax expert.

Health Care Provider User Fees. A sales tax exemption certificate. The exemptions discussed below do not represent a comprehensive list of Illinois Sales Tax.

The following is a list of items that are exempt from Connecticut sales and use taxes. There are exceptions to the 635 sales and use tax rate for certain goods and services. Ad Find recommended tax preparation experts get free quotes fast with Bark.

As with all Sales Use Tax research the specifics of each case need to be. Exemption from sales tax for items purchased with federal food stamp coupons. How to use sales tax exemption certificates in Connecticut.

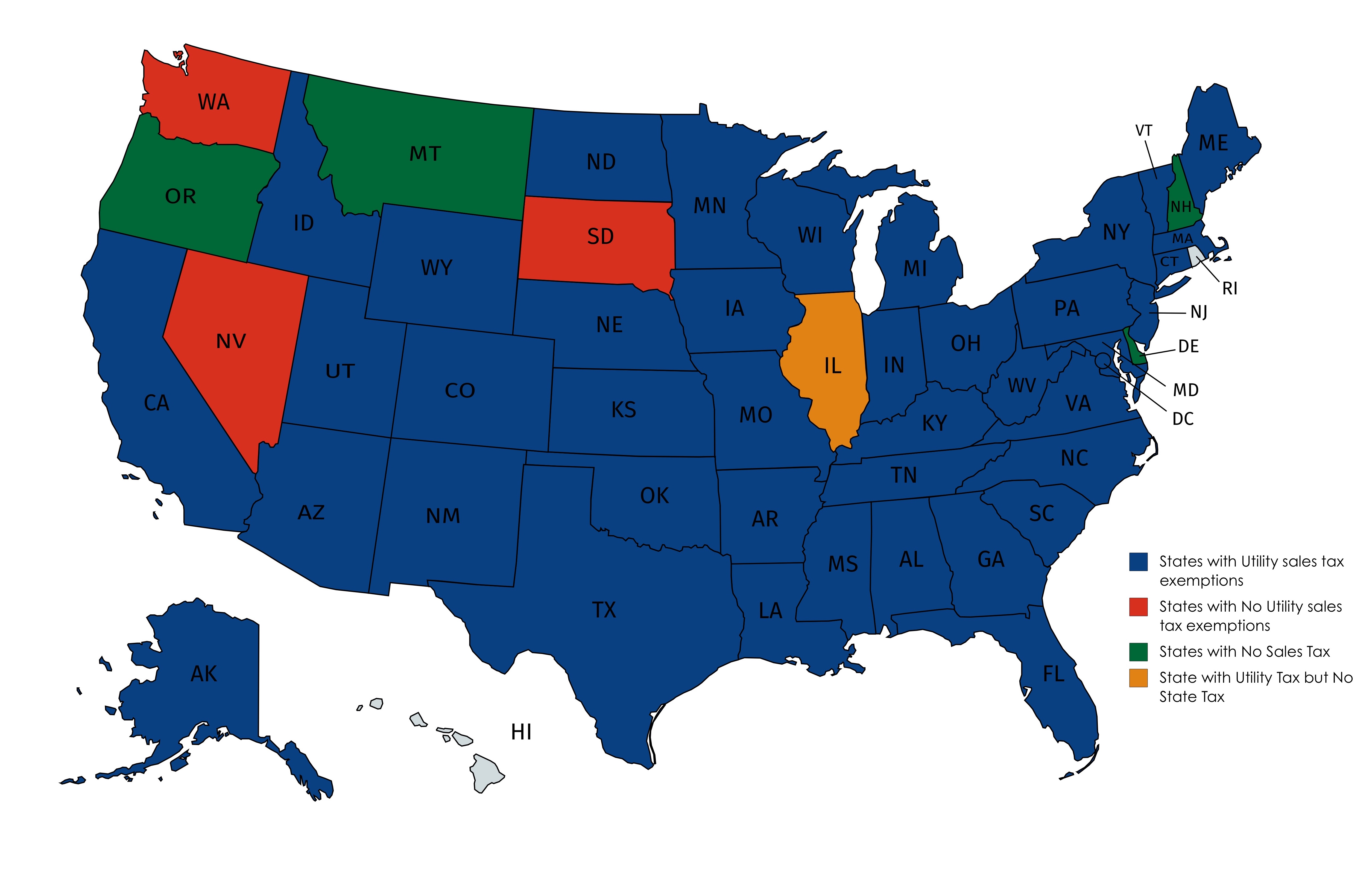

States Served National Utility Solutions Predominant Use Study Experts

Connecticut State Taxes 2020 2021 Income And Sales Tax Rates Bankrate

How To File And Pay Sales Tax In Connecticut Taxvalet

State Cuts Sales Tax Permit Period To Two Years Cbia

Exemptions From The Connecticut Sales Tax

Connecticut Sales Tax Exemptions Agile Consulting Group

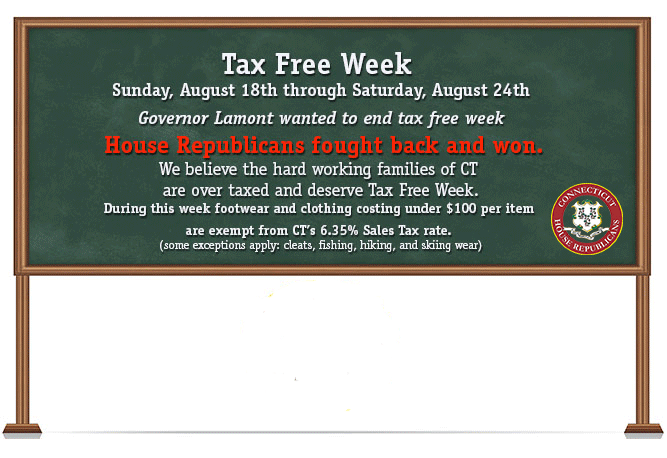

2022 Connecticut Sales Tax Free Week

Sales Tax Exemptions And Native Americans Avalara

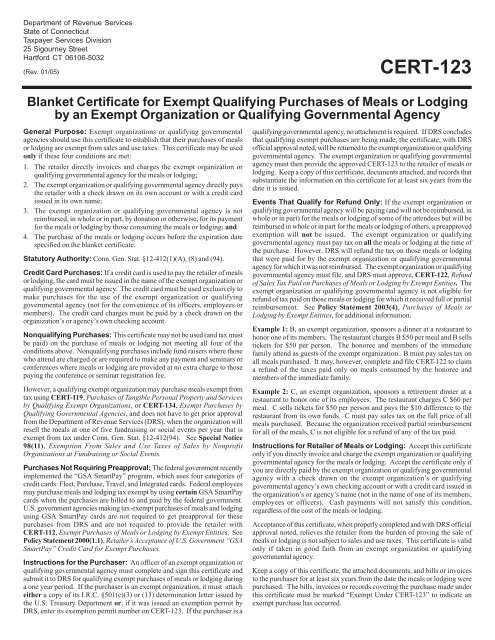

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

How Are Groceries Candy And Soda Taxed In Your State

What To Know About Ct S 2022 Sales Tax Free Week Nbc Connecticut

Sales Tax Holidays The Cpa Journal

Connecticut Delinquent Taxpayers And New Exemptions Avalara

Sales Taxes In The United States Wikipedia

Cert 123 Blanket Certificate For Exempt Qualifying Ct Gov

States Served National Utility Solutions Predominant Use Study Experts

Wayfair Dramatically Changes Drop Shipment Sales Tax Obligations Exemptax Blog